Communications of the ACM

The Holy Grail of Electric Vehicles: Solid-State Batteries

Unlike flammable liquid-core Li-ion batteries, Blue Current’s solid-core silicon elastic composite solid-state batteries are smaller, safer, and will last the lifetime of an electric vehicle.

Credit: Blue Current

Rechargeable batteries have become the lifeblood of electronics, enabling the mobile revolution. Unfortunately, today's rechargeable batteries incorporate flammable liquid cores. That could change soon, however by switching to rechargeable batteries that have solid cores with nothing to spill, nothing to catch on fire, nothing to potentially explode.

The first rechargeable battery was invented in the mid-19th century, and replaced the crank handle on the front of Model Ts— the lead-acid battery, which is based upon a simple liquid sulfuric acid core. Because of their low cost and relatively large power-to-weight ratio, these batteries still provide the spark that starts today's internal combustion engines (ICEs).

The more advanced liquid-core lithium-ion (Li-ion) batteries powering everything from smartphones to electric vehicles (EVs) are more expensive than lead-acid batteries, but they are worth it because they are lighter and smaller than lead-acid batteries providing the same amount of power, making them more suitable for mobile devices. Even the flammable liquid cores that make Li-ion batteries less safe than the liquid cores of lead-acid batteries are tolerated because of their reduced size.

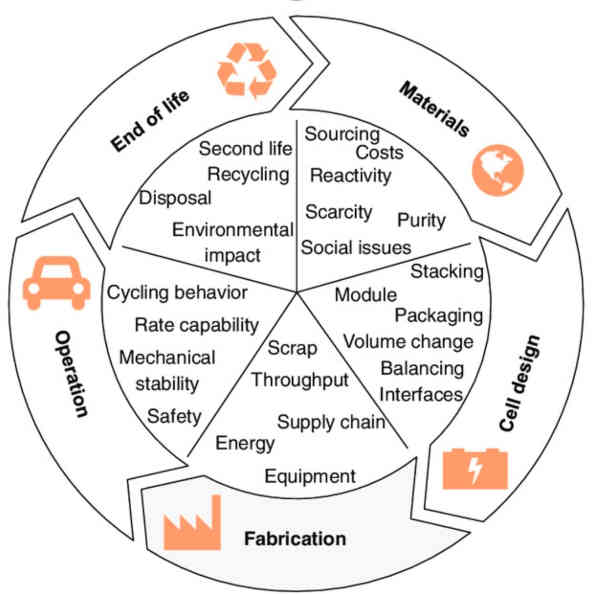

According to the U.S. Department of Energy (DoE) Joint Center for Energy Storage Research (JCESR), an Energy Innovation Hub led by DOE's Argonne National Laboratory, the Li-ion battery's flammable liquid core is on its way out. Not only is it flammable, but it also creates a toxic-waste disposal problem, introducing increasingly complex manufacturing problems and making the cost of electric vehicles (EVs) almost prohibitively high.

To remedy the problem, Argonne National Labs created JCESR, which designed a new generation of batteries with non-liquid solid cores — in the solid "state"—that are smaller, have higher energy density, and yet promise to return to the safety, ease of manufacturing, and lower cost of lead-acid batteries (once they are in mass production). Solid-state batteries were heralded as the "holy grail of batteries" — their solid-state core is the perfect complement to solid-state electronics — in the Technology Outlook 2030 report by market research firm DNV (Det Norske Veritas, which means "the Norwegian truth").

All rechargeable batteries work in approximately the same way: two metallic electrodes are separated by a charge-bearing electrolyte. Lead-acid batteries (which use lead electrodes separated by a concentrated but fire-proof liquid sulfuric-acid electrolytic core) are the safest and cheapest, albeit also the biggest in terms of size and weight. Energy is supplied when negatively charged ions travel through the liquid-core electrolyte and out the negative electrode to power an electrical device. As the battery's charge depletes, its liquid sulfuric-acid electrolytic core loses concentration. Charging the battery restores the concentration of the liquid sulfuric-acid electrolytic core, and the cycle repeats.

Lithium-ion batteries work similarly and have largely replaced lead-acid batteries in devices where cost is less important than size and complexity — the Li-ion battery's components include lithium, graphite, nickel, cobalt, separator membranes, and various formulations of flammable electrolytic core liquids. Li-ion liquid cores hold more charge than lead-acid formulations, thus reducing the size and weight requirements of the battery. However, all varieties of Li-ion batteries share the same hazard of explosive flammability of their liquid core, thus requiring extra materials and internal structures to protect against their toxicity during use and even after their lifetime has expired. Thus, for safety's sake, to reduce costs and to further miniaturize the next generation of batteries, higher-density solid-core electrolytes are on the horizon, according to DNV.

For instance, DNV notes that Tesla, Toyota, and Samsung each have their own solid-core battery technologies under development for EVs, as well as for ships, airplanes, and for grid-level storage of electricity generated by solar, wind, and other sources of sustainable power. Beyond those, most automakers are putting their trust in third parties to develop the solid-core batteries of the future. For instance, Audi, Bentley, BMW, Ducati, Ford, Hyundai, Lamborghini, Porsche, Skoda, and Volkswagen are making major investments into solid-core rechargeable battery startups Solid Power ($400-million market capitalization) and QuantumScape ($2.3-billion market capitalization).

The high stakes of proving the viability of solid-core batteries in EVs recently persuaded Koch Industries to invest $30 million into a megawatt-scale pilot factory for JCESR spin-off Blue Current. Unlike the other start-ups, Blue Current lays claim to low-toxicity solid core intellectual property (IP) that the DoE endorsed via JCESR as the safest, cheapest, and highest-density solid-core battery design to date, enabling a single battery to last the lifetime of an EV.

Their improved safety, smaller bill of materials and life-of-the-device longevity favor them, but only mass production

after adoption by a major electric vehicle maker will lead them to eventually replace the widely available Li-ion battery.

Credit: Solid versus Liquid—A Bottom-Up Calculation Model to Analyze the Manufacturing Cost of Future High-Energy Batteries

EVs drive investment

"What is happening is we are moving to EVs no matter what — the trends are being driven by consumer demand, government mandates, and big return-on-investment outlooks," said Simon Jowitt, associate professor of economic geology at the University of Nevada in Las Vegas (UNLV). "Right now, Li-ion batteries are the best bet, but the market is very volatile; there is only enough lithium in Nevada, for instance, to create 300 million EVs. And with demand growing rapidly, not only lithium, but graphite, nickel, and cobalt could become scarce. That's why the bigger car companies are all investing in solid-state battery technologies to hedge their bets and keep pace with change."

DNV extrapolates that over the next seven years, lithium-ion batteries will shrink in price from $130 per kilowatt-hour (kWh) to $100/kWh, even as they grow in density from 200 kWh per kilogram to more than 300 kWh/kg, which could push low-end EV prices down from $50,000-to-$70,000 today to the $20,000-to-$30,000 range by 2030. By that time, however, DNV speculates that solid-state batteries could be 15% to 35% cheaper than Li-ion batteries as reported by solid-state battery maker Solid Power, and 50% higher in electrical storage capacity than Li-ion as reported by Electrek, a news site whose coverage focuses on the auto industry's transition "from fossil-fuel transport to electric transport."

Jowitt pointed to increasing safety issues with Li-ion batteries as they approach their theoretical limit, "and not just with the batteries themselves, which are flammable, but in the recycling and storage of worn-out batteries." He said the industry needs "a circular lithium economy to prevent our scrap yards from filling up with toxic Li-ion battery waste, but right now that recycling infrastructure is not here. Also mining lithium is difficult, dangerous, and socially unpopular —as in 'not in my backyard'."

In addition, Jowitt said, while greener lithium extraction techniques are under development, "The economic timing is also a problem, because the EV market is so volatile. Lithium demand for EVs is relatively low now, but if demand takes off too quickly, lithium will get expensive. On the other hand, if a lot of new lithium mines come online all at once, the price may drop too much to affordably develop greener mining techniques."

Not all analysts are convinced solid-core batteries will displace liquid-core batteries; at least, not without major solid-state breakthroughs.

"Personally, I am not too optimistic about solid-state batteries in the near future. They have been 'just around the corner' for over five years now, although they are more likely to succeed for EVs than for other applications like ships, planes, and grid storage," said Henrik Helgesen, senior battery consultant to DNV. "Solid-state batteries, however, do have a theoretically higher energy density over liquid-core Li-ion batteries, making their cell size smaller."

According to Ben Eiref, chief executive officer of Blue Current, solid-state Li-ion longevity is the most important metric, since that will allow them to last the lifetime of an EV. Safety is a major advantage too, but even solid cores could fail (albeit not as spectacularly as flammable liquid cores). "Our solid-state batteries are safer than liquid-core Li-ion batteries, but there is still a lot of energy stored that could be released if damaged in an auto collision. Our goal at Blue Current is to make solid-state batteries that do not fail violently, the way Li-ion batteries catch on fire or even explode."

Blue Current's second-generation design, claims Eiref, will achieve its desired safety metric by operating at room temperature and "at pressures a lot lower than other first-generation solid-state battery technologies." The key, he says, is the company's patented "silicon elastic composite" construction. The use of adhesives in the battery's solid silicon/polymer composites insures a higher energy density than liquid cores, but without resorting to the high temperatures and pressures required by first-generation solid-state batteries. As such, Blue Current's pilot line will prove (or disprove) their superiority compared to Li-ion, said Eiref.

R. Colin Johnson is a Kyoto Prize Fellow who has worked as a technology journalist for two decades.

No entries found