Communications of the ACM

Stock Traders Find Speed Pays, in Milliseconds

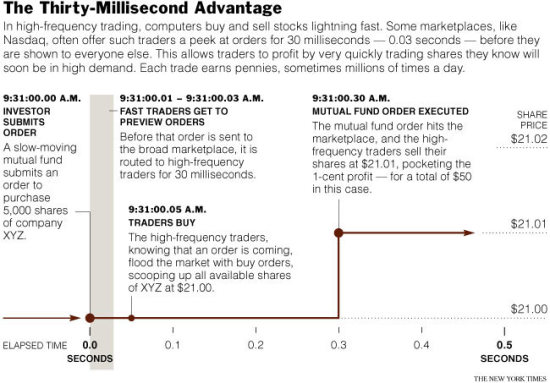

Practitioners of high-frequency trading use powerful computers to transmit millions of orders at incredible speed, and critics warn that the method could be used to manipulate prices. Wall Street's computers employ muscular algorithms to process millions of orders a second and scan dozens of public and private marketplaces concurrently. This enables users to get a jump on marketplace trends and shift tactics in a matter of milliseconds. "This is where all the money is getting made," says former New York Stock Exchange (NYSE) CEO William H. Donaldson. "If an individual investor doesn't have the means to keep up, they're at a huge disadvantage."

Stock exchanges say that a mere handful of high-frequency traders now account for more than 50 percent of all trades. "It's become a technological arms race, and what separates winners and losers is how fast they can move," says Joseph M. Mecane of NYSE operator NYSE Euronext. "Markets need liquidity, and high-frequency traders provide opportunities for other investors to buy and sell." The Tabb Group estimates that high-frequency traders generated about $21 billion in profits last year.

"You want to encourage innovation, and you want to reward companies that have invested in technology and ideas that make the markets more efficient," says T. Rowe Price's Andrew M. Brooks. "But we're moving toward a two-tiered marketplace of the high-frequency arbitrage guys, and everyone else. People want to know they have a legitimate shot at getting a fair deal. Otherwise, the markets lose their integrity."

From The New York Times

View Full Article

Abstracts Copyright © 2009 Information Inc., Bethesda, Maryland, USA

No entries found