Communications of the ACM

Betting Exchange Proposed as Means to Valuing Toxic Assets

Credit: iStockPhoto.com

Valuing toxic assets or securities built on sub-prime mortgages has been an arduous task for worldwide economic systems. The difficulty is in pricing assets whose value has declined so significantly that government intervention is required to buy the assets or bail out the banking system. Now a key approach is being proposed by Alan Holland of the Cork Constraint Computation Centre at University College Cork, Ireland. Holland, a member of the Programme Committee for the 2009 ACM Conference on Electronic Commerce, advocates using prediction markets, an online market mechanism, involving experts and non-experts to provide a collective intelligence for forecasting toxic-asset prices.

An online market mechanism can be used to aggregate the opinions of many individuals regardless of the model they use to determine their asset price estimates. The mechanism should strike a balance between encouraging well-considered trades and increasing liquidity. Some popular approaches include Hanson's logarithmic market scoring rule, continuous double auctions and dynamic pari-mutuel markets.

Holland says that "needless to say, the resistance of mechanisms to strategic manipulation is of paramount importance in this application domain." Mechanisms are currently an active research topic in the electronic commerce community.

The catalyst for Holland's proposal is the deflating property bubble in Ireland, where approximately euro 80 billion worth of impaired loans have marred its banking system. The toxic assets are to be transferred from Irish banks to the National Asset Management Agency (NAMA), a government body that will acquire the faulty loans. The difficulty is in determining prices in the absence of a liquid market that will at least offer a break-even return to taxpayers in five to 15 years time. NAMA has hired property valuation experts to determine prices of the loans, which are crucially dependent on property valuations. But Holland insists that they do not have enough knowledge to accurately affect the pricing outcome.

An Internet-based method managed by a company like Dublin-based Intrade would be more responsive to current events and would work with active participation by Ireland's citizens, who are more familiar with their locales than a property valuator, Holland says.

David Pennock, Principal Research Scientist at Yahoo! Research in New York, agrees. Creating a prediction market in this case could address Ireland's liquidity problem. "It would open it up to more people weighing in on the asset," Pennock says. "That could help extract out a price, where the regular market is failing."

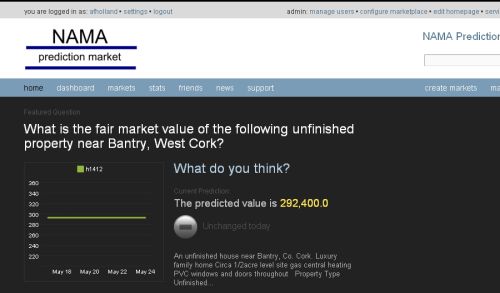

NAMA prediction market participants can view properties in their locality and read the keyattributes before making a trade. Credit: National Asset Management Agency NAMA prediction market participants can view properties in their locality and read the keyattributes before making a trade. Credit: National Asset Management Agency |

An Internet-based prediction market allows participants to assume a stake in a security whose value is tied to a future event, Holland explains. Securities whose value depends on the transfer amount paid for loans from NAMA to the bank would be created. Bets are accepted based on whether the price is higher or lower than NAMA's internal estimate. Members of the public would bet on what price will be set for the transaction based on the quoted figure.

Holland argues that "this will substantially reduce the cognitive burden for the government agency and improve the accuracy, speed and scalability of pricing"

No entries found